Call to speak to a Licensed Insurance Agent

Mon - Fri 8am – 8pm EST; Sat - Sun 10am - 6pm EST

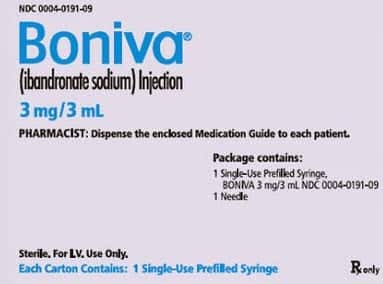

Medicare does provide coverage for Boniva, which is also known as ibandronate. However, it’s important to note that the brand-name Boniva is no longer sold in the U.S.

While Medicare generally covers the cost, there are specific conditions that you must meet for this coverage to apply.

Understanding the specifics of Medicare coverage is important for effective healthcare financial planning. This article provides information on the conditions under which Medicare covers Boniva to assist in making informed treatment decisions. Continue reading to learn:

The short answer is yes; Medicare will cover the cost of Boniva. (Note that Boniva is no longer available in the US. Boniva is the brand name for ibandronate, which is still prescribed.)

Many in healthcare, however, still call ibandronate “Boniva” since it’s easier to say.) But not 100% of the time. As is often the case with Medicare, certain conditions must be met in order for Medicare to pick up the tab. Below we look at what these are so you know what to expect.

Original Medicare (Medicare Part A and Part B) provides coverage for Boniva. Original Medicare provides coverage for injectable medications for treating osteoporosis. So that means, they are likely to provide coverage for injectable Boniva.

Coverage for the injectable osteoporosis drug (Boniva) is provided by Medicare Part B. Aside from providing coverage for injectable osteoporosis medications, Original Medicare may also help cover the cost of a home health nurse to administer the injectable osteoporosis drug (ie. Boniva).

But only under these conditions:

If you are eligible, Original Medicare will also fully cover the costs of the home health nurse visit to administer the injection for you.

Once approved, Medicare Part B will pay for 80 percent of the costs of your injectable osteoporosis drug. You will pay for the remaining 20 percent.

Medicare Advantage plans (Medicare Part C) also provide coverage for Boniva. They cover everything Original Medicare covers as well as offer some additional benefits.

However, exactly what they cover and how much the out-of-pocket costs are will vary depending on the specifics of your plan.

Medicare Part D also provides coverage for Boniva. 99 percent of Medicare Part C and Part D plans provide coverage for Boniva.

Most Medicare plans restrict how much Boniva you can get at a time. If you need get any more than that, Medicare may not cover it.

In this case, you can wait until a certain amount of time has passed before refilling. Or, if you really need more than the permitted amount of Boniva in a single purchase, you can contact your plan provider and ask for an exception.

So, bottom line here is Original Medicare will likely cover the injectable form of Boniva for those who need it. But likely won’t cover the tablet form. However, most Part C and D plans will cover the tablets.

The average cost of 1 dose (3 pack tablets) of 150 mg Boniva is about $340. For the injectable version, it costs about $560 for a 3 ml supply. These prices are for those who do not have insurance.

Boniva, also known as ibandronate, is prescribed for treating osteoporosis in postmenopausal women. If you have Medicare Part B, it can cover some of the drug’s cost, but you may have additional out-of-pocket expenses. The amount you pay can vary based on your specific Medicare plan.

There is a coverage gap in Medicare known as the “donut hole.” When your yearly spending on prescription drugs reaches a certain amount, you will enter this gap and may have to pay the full cost of Boniva, although a small discount is applied. This gap is expected to close in 2023.

Regarding out-of-pocket costs associated with a Medicare plan for Boniva, they generally include:

In addition to Original Medicare, you have other options for covering the cost of Boniva and similar osteoporosis medications. One alternative is Medicare Advantage Plans, often referred to as Part C.

These private insurance plans offer all the benefits of Original Medicare and frequently include extra features like coverage for prescription drugs, vision, and dental care.

While most of these plans do cover Boniva, be aware that some may have higher copays or deductibles. Another choice is Supplemental insurance, commonly known as Medigap plans.

These plans fill in the gaps that Original Medicare doesn’t cover, such as copays and deductibles, and some even offer prescription drug coverage.

As you explore these options, it’s important to compare different plans to see how they cover Boniva and to find one that suits both your healthcare needs and budget.

Consult your doctor about managing Boniva costs. They may recommend a generic version or an alternative osteoporosis medication that’s more affordable.

Your doctor can also clarify how Medicare covers Boniva. Consider using the generic form of Boniva to potentially reduce expenses. If your doctor approves, this could be a cost-effective alternative.

Explore patient assistance programs. These programs, often provided by pharmaceutical companies or non-profit organizations, may offer Boniva at a reduced price or even at no cost.

Stay informed about Medicare’s formulary changes. The formulary is a list of drugs that Medicare covers, and knowing its contents can help you prepare for any out-of-pocket costs related to Boniva.

Make use of Medicare’s annual prescription drug coverage review. This is an opportunity to consult your doctor and reassess whether Boniva is the most suitable medication for your condition under your current Medicare plan.

If Boniva is removed from Medicare’s formulary, consult your doctor for alternative treatment options that are covered by Medicare. You may also explore additional patient assistance programs to obtain Boniva at a more affordable rate.

Boniva is a medication prescribed for post-menopausal women to treat or prevent osteoporosis. It functions by slowing down bone degradation, making bones less susceptible to fractures.

The active substance in Boniva is ibandronate, a bisphosphonate which adheres to bone and inhibits its breakdown.

Boniva operates by decelerating the degradation of bone, thereby increasing bone density and lowering the likelihood of fractures.

Boniva is generally prescribed for women who have a higher risk of developing osteoporosis. Risk factors may include:

Osteoporosis is quite common, affecting approximately 1 in 3 women over the age of 50. It leads to weakened bones, increasing the risk of fractures.

Clinical studies indicate that Boniva is effective in reducing fracture risks. It has been shown to lower the risk of spinal fractures by 40% and hip fractures by 33%.

While generally well-tolerated, Boniva can cause side effects such as:

Boniva is not recommended for women who are pregnant or breastfeeding. It should also be used cautiously by individuals with certain medical conditions, such as kidney problems or stomach ulcers.

In summary, this article has provided a comprehensive guide on Medicare’s coverage for Boniva, a medication crucial for treating osteoporosis in postmenopausal women.

We’ve delved into the specific conditions that must be met for coverage, and discussed how different parts of Medicare, including Part B, Part C, and Part D, can impact your out-of-pocket costs. Understanding these factors can help you make well-informed decisions about your healthcare and financial planning.

If you found this information valuable, please consider sharing the article or leaving a comment. Your engagement helps others in similar situations find the guidance they need.

Medicare Part A and Part B can help pay for some osteoporosis medicines given through a needle or IV. These could be drugs like Boniva, Reclast, Prolia, or sometimes Miacalcin. Part B usually pays for 80% of these costs. To start getting this help, you first have to meet your Part A deductible. Part B also fully pays for a bone density test every two years.

Medicare drug plans usually put ibandronate on Tier 2 of their drug list. The higher the tier, the more you pay for the medicine. This drug helps keep bones strong and lowers the chance of breaks. It’s part of a group of drugs called bisphosphonates.

The medication Boniva is no longer available for purchase in the United States. Nonetheless, both healthcare providers and the general public often continue to use the name “Boniva” when referring to its scientific counterpart, ibandronate, due to its ease of pronunciation.

Boniva has a generic version called ibandronate. Fosamax’s generic version is called alendronate. A generic drug is like a twin to the brand-name medicine. It has the same active ingredient and works just as well and safely as the original.

Yes, there’s a study found that Boniva (known as ibandronate) helps increase bone density in women after menopause. Those taking Boniva had better results than those who didn’t.

Note: Medicare coverage changes all the time. And your specific coverage may vary from plan to plan for Medicare Advantage and Medigap plans. Always be sure to double check with your health care provider and/or Medicare insurance provider about what your plan covers and what it does not.

Learn about Medicare coverage for other treatments in our articles about Medicare coverage for deviated septum surgery and does Medicare cover pelvic floor therapy?